Contributing writer Jorge Izquierdo is the VP of market development for PMMI, The Association for Packaging and Processing Technologies.

HERNDON, VA — Packaging has always been a balancing act. Consumer packaged goods (CPG) companies must weigh cost vs. performance and market appeal vs. machinability. As interest in sustainable packaging has grown, brand owners also must balance circularity with price, safety, distribution requirements, material availability and overall environmental impact. This requires a dialogue among stakeholders about packaging design, material choices and end-of-life disposal options.

To begin this conversation, PMMI, The Association for Packaging and Processing Technologies, and AMERIPEN, the American Institute for Packaging and the Environment, have published the 2023 Packaging Compass: Evaluating Trends in US Packaging Design Over the Next Decade and Implications for the Future of a Circular Packaging System. The study identifies key trends in packaging design and materials and the implications of these trends on legislation and recovery systems for CPG companies.

“By releasing this deep dive into the trends driving the circular packaging system, we hope to facilitate an industry dialogue that will help close the gap between design needs and recovery needs,” said Jorge Izquierdo, VP of market development at PMMI.

Based on extensive research and analysis, the study’s goal is to spark a conversation on trends, present forecasts for the coming decade, and recognize the role of multiple stakeholders in advancing a circular packaging system.

Plastic packaging sales projections

The 10-year forecasts and materials sales projections indicate plastic packaging, particularly the flexible pouch format; recycled-content packaging, primarily paper and plastic; and compostable packaging will experience the highest demand, although the latter represents a small share of the market. Despite the disparity in usage, these three formats have the same hurdles to overcome: a lack of end-of-life recovery infrastructure as well as effective legislative and investment strategies.

A survey of 394 CPG brands and retailers showed:

- 75% use plastics in packaging

- 61% use paper

- 14% use glass

- 13% use metal

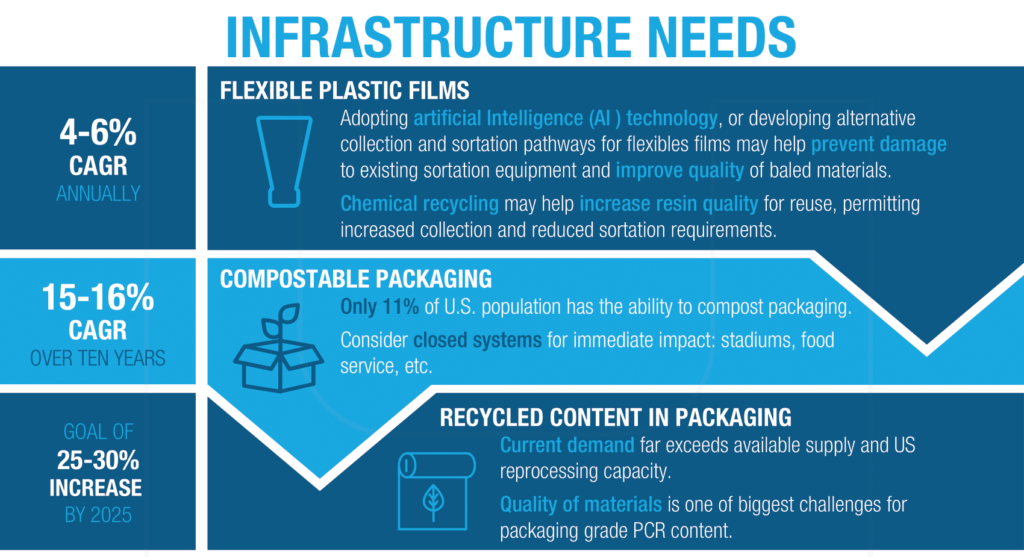

Projections show plastics will grow across every category, and the use of flexible film will expand at a 4% to 6% CAGR, slightly above the 3% to 4% CAGR for plastics overall. Plastic films offer significant operational and sustainability benefits. Tensile strength delivers more protection with less material. Lightweight and compact footprints reduce carbon emissions during distribution. Highly customizable materials run efficiently on filling lines and reduce overall cost and cycle time. Consumers appreciate the format’s lightweight, reduced shelf space requirements and potential for easy-opening and resealing features.

Although usage continues to grow, figures from the Recycling Partnership show only 1.9% of the US population has access to flexible film recycling. Most of this film is recovered from retail drop-off programs, but consumer participation in these programs is low. As a result, establishing a circular economy for flexible films will necessitate a substantial expansion in recycling infrastructure that involves better collection, sortation and end-of-life reprocessing, potentially including the widespread use of chemical recycling.

The report explains chemical recycling is an emerging technology that reverts materials to their original monomers. Its adoption could enhance opportunities for the circular reuse of flexible films by increasing collection, lowering sortation requirements and improving recycled resin quality by reducing contamination, color, or scent concerns, thereby simplifying the regulatory acceptance of recycled resins for food-contact applications.

Expanding consumer access to composting

Compostable packaging has a projected CAGR of 15%-16% during the next decade and is receiving a lot of attention because there is a perception that it offers a less-complicated end-of-life option. However, composting also suffers from a lack of infrastructure. According to statistics from the Sustainable Packaging Coalition, only 27% of the US population has access to curbside composting programs, and only 11% of those composting programs accept packaging.

To realize the full circular potential of compostable packaging, the US needs to increase consumer access to composting by investing in the collection of compostable materials and in expanded access to composting facilities that accept food scraps along with packaging. As the US looks at investments into the necessary collection and processing infrastructure, the most immediate impact is likely to be attained if closed systems like stadiums, food service outlets and cafeterias were implemented before household collection programs.

Recycled-content packaging is a popular path toward circularity. Design for recycling guidelines have been developed by several organizations and are helping the packaging industry choose combinations of polymers, labels and additives that do not hinder a package’s recyclability. Many brand owners use these guidelines to help meet commitments to increase the use of recycled content.

Unfortunately, a disconnect between strong demand and insufficient supply and processing capacity for recycled resin must be overcome. Like flexible packaging, potential solutions lie in simplified and improved collection, better sortation techniques and greater capacity for end-of-life reprocessing. Chemical recycling could be a potential way to increase capacity as well as recycled resin quality.

Improving infrastructure

Achieving a circular economy depends on improving the infrastructure for collection, sortation and end-of-life reprocessing. Policy changes will be needed to achieve these objectives. According to the report, establishing a circular economy will depend on the development of:

Extended producer responsibility (EPR). EPR programs shift financial and operational responsibility for end-of-life management of products to producers instead of taxpayers and the government. As of spring 2023, four states (California, Colorado, Maine and Oregon) have enacted EPR requirements, and more states are considering EPR bills. However, a national law would overcome a patchwork of differing state requirements and simplify compliance.

The research within this study indicates EPR programs should include a focus on ways to improve the quality and quantity of recycled materials. Key considerations should explore how best to invest in the composting infrastructure, including packaging, and address how to handle hard-to-recycle materials by investing in collection and sortation technology and supporting end-market development. The data also show package design needs to consider many factors beyond design for recycling. Leveraging EPR to help balance all the design variables should create benefits for each stakeholder.

Universal access. Providing all households with convenient and consistent access to recycling and composting services would increase collection.

Standardized definitions. Definitions for commonly used terms like recycling and composting would ensure stakeholders are communicating a consistent message and reduce consumer confusion.

Alternatives to material bans. Material bans can prevent CPG companies from choosing the optimum packaging material and increase a product’s environmental impact. Shifting from material bans to dialogues about collection, sorting and reprocessing gives brand owners the freedom to pick the best option.

Recovery innovation. Federal investments into programs uncovering emerging science and data are needed to drive efficiencies across packaging design and waste management.

Data collection. Consistent data collection will help measure and benchmark the performance of a circular packaging economy.

Reusables infrastructure. Reusables are another promising option to achieve circularity. However, as with other options, infrastructure is lacking, and investment is needed. According to the report, successful reusable packaging programs depend on redesigning distribution systems for reverse logistics. This will involve establishing safe and hygienic drop-off or pick-up collection points, which are convenient to consumers, and equipping production lines for washing and refilling.

Currently, the adoption of reusables poses a daunting challenge for many packaging companies due to the costs to develop and scale a system to achieve a significant impact. A collaborative strategy that incentivizes innovation is needed. Understanding the challenges and opportunities of reusables will require participation from a wide range of stakeholders.

Achieving a circular economy

A circular economy can be achieved by focusing on how best to invest in recycling and composting infrastructure across the US and tying that dialogue to what is happening with packaging design and the multiple variables packaging designers must juggle. Success will depend on how well members of the packaging value chain understand each other’s challenges and opportunities.