Product quality and attributes became a critical factor when consumers who did not suffer financially wanted to upgrade their at-home eating experiences. Frossard attributed this to not only economic stimulus programs and increased job opportunities but also to what he referred to as the “trade-up effect.”

“People paid the extra money to have superior product and try to replicate a restaurant experience,” he said.

Frossard also noted that indulgent items such as birthday cakes were purchased in smaller sizes, but the price point was not necessarily commensurate with the size.

“It didn’t mean that you’d have a cake that was half the size and want to pay half the price,” he said. “People were willing to pay the same or more for something really good.”

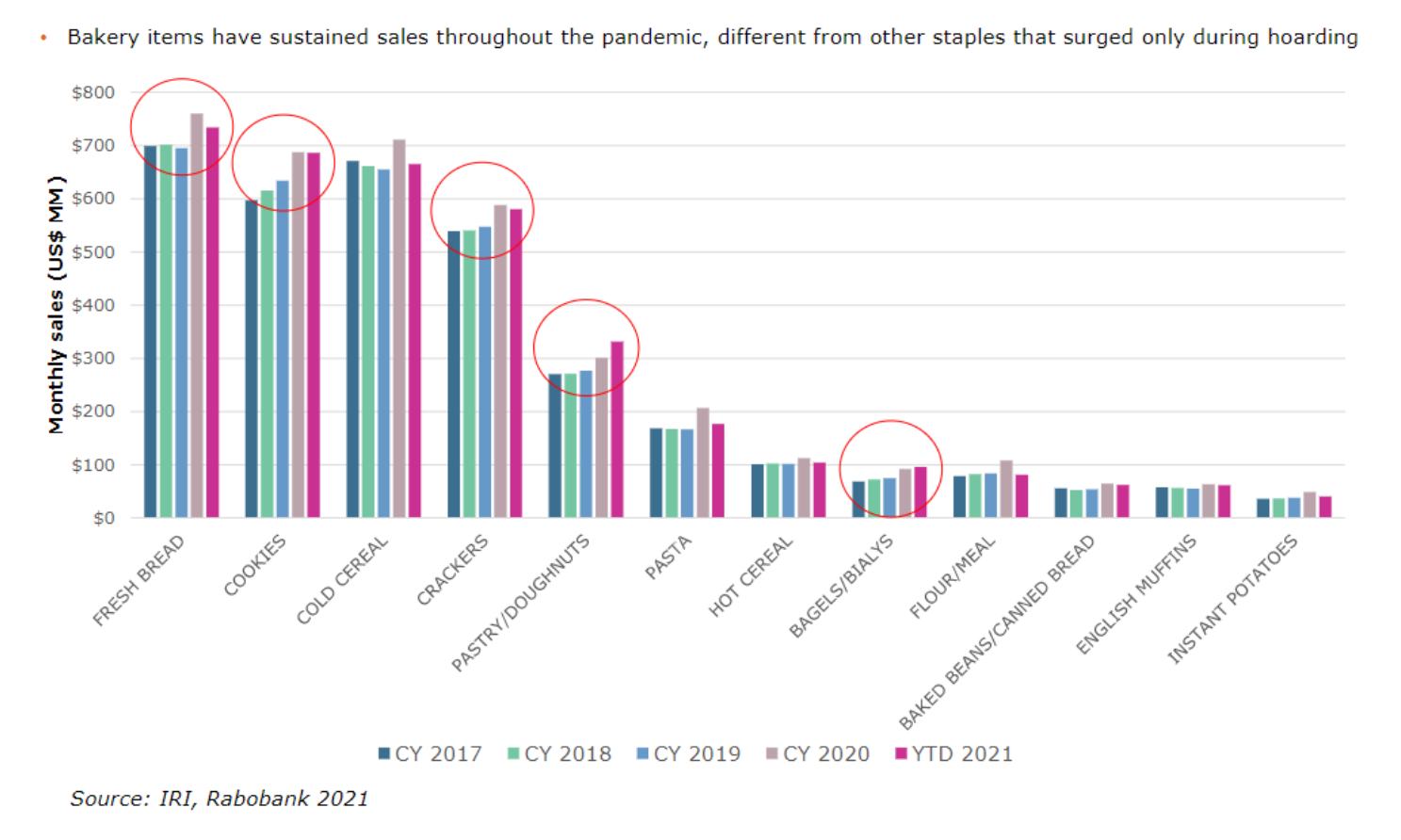

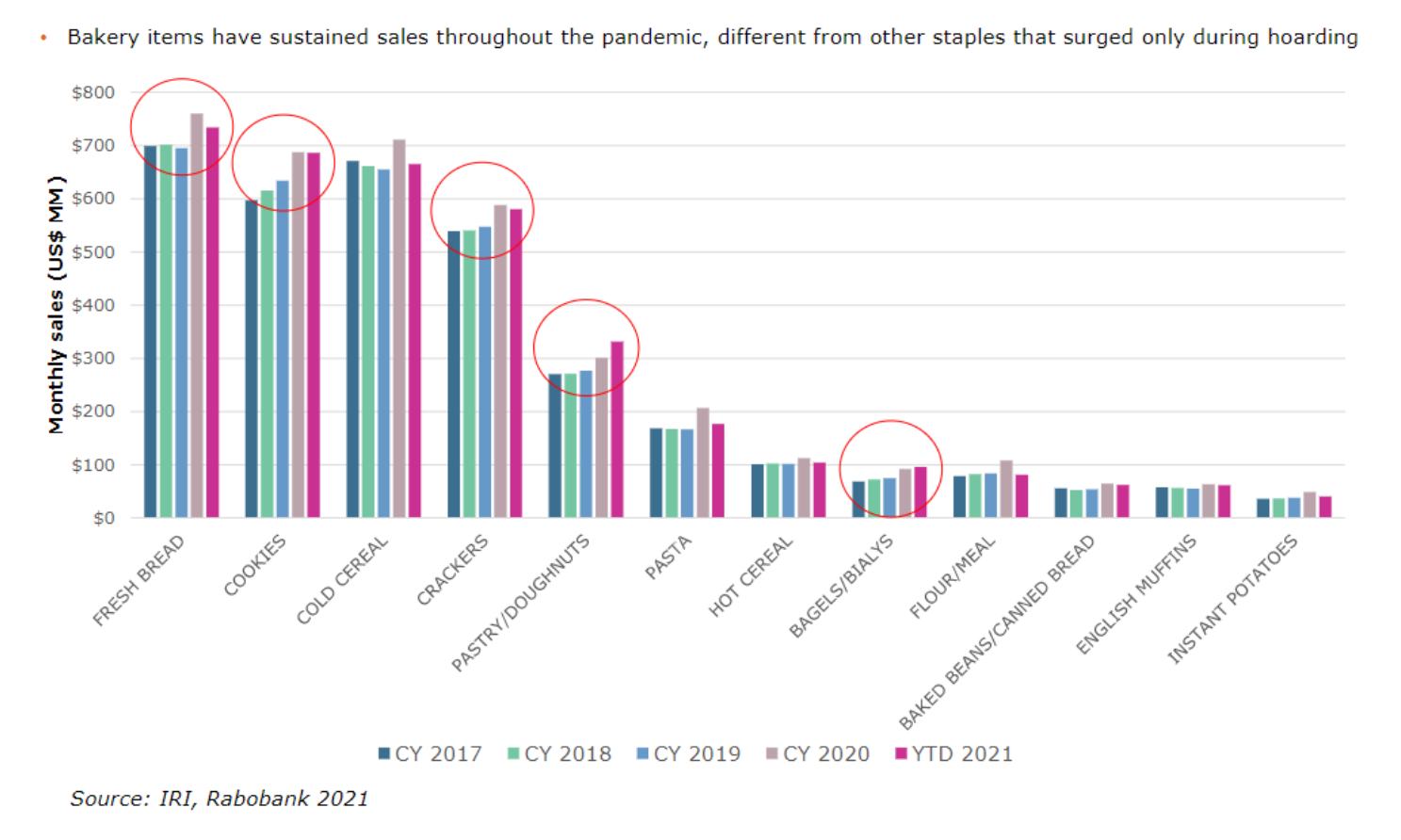

Filott noted that these changing habits led to increased sales for bakeries, especially those selling in retail, and it has created momentum that, for many bakery categories, is still going strong in 2021.

“Certain food categories that surged in the heat of the momentum – including pasta and flour — have gone back to 2019 levels,” Frossard added. “But that’s not the case for bakery breads. They’re still part of consumers’ routine.”

Additionally, the pastry/doughnuts category has grown this year even beyond 2021 levels, according to Rabobank data.

Frossard suggested that it could be due to the ease of production in the in-store bakery.

“It doesn’t require that much labor to be sold in the in-store bakery,” he said. “It’s just a thaw-and-serve. It makes life easier on the retail side, and we are at the age of low complexity; that’s a hot offer right now.”

As labor shortages hit nearly every industry, retailers are jumping on products that don’t require a lot of human capital in areas like the supermarket perimeter.

Then again, with people out shopping more, consumers are back in the supermarkets as well as shopping online.

Places people look for products may be experiencing the biggest evolution of all.

“The consumer is back, and they’re shopping not only the bakery center aisle but the frozen area as well,” Frossard said. “Bakeries can take advantage of that.”

But perhaps the most critical shift has been the surge in e-commerce. Despite the fact that online grocery sales declined slightly in Q2 2021 according to Rabobank, the numbers were still significantly ahead of 2019.