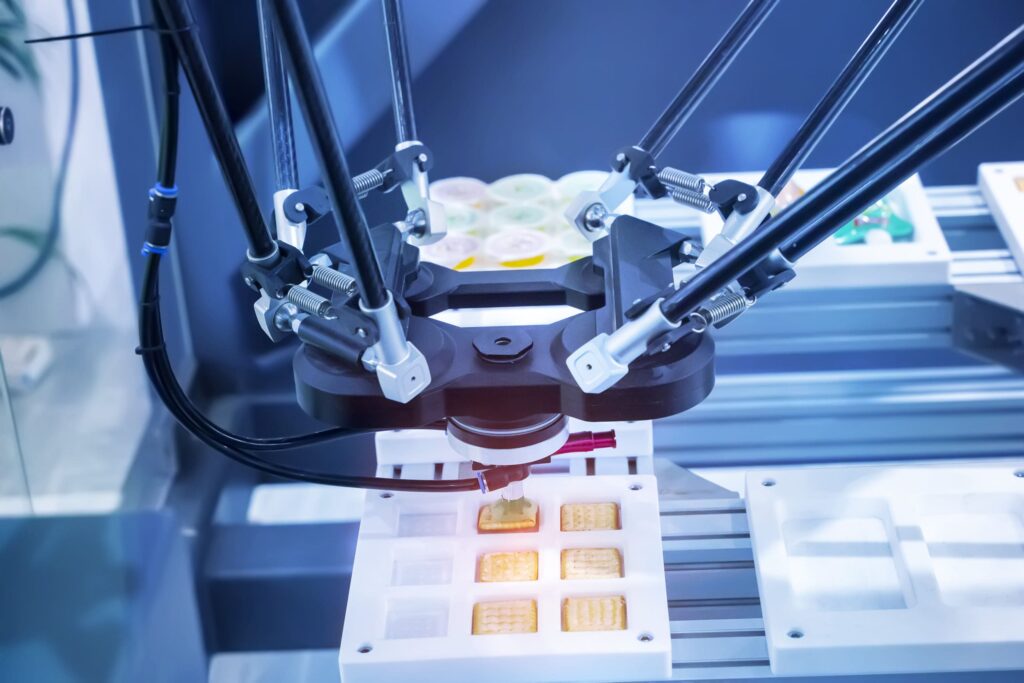

LAS VEGAS — In the midst of the pandemic’s upheaval, perhaps no other aspect of manufacturing felt the impact more than consumer packaged goods (CPGs), and suppliers of packaging and processing technologies, as store shelves were depleted, especially in the bread and baked goods aisles.

At PACK EXPO Las Vegas, held Sept. 27-29, Jorge Izquierdo, VP of market development PMMI, which owns and organizes the show, outlined his findings on the impact in the association’s state of the industry report. Findings included insight of trends stemming from the changes that happened in 2020.

“Last year was a crazy year, especially for CPGs,” Izquierdo said. “It was run, run, run.”