Bagels appeal to eating occasions across dayparts, creating opportunities for producers to promote uses beyond breakfast.

“Consumers constantly seek new and interesting ways to use familiar products, and many are willing to try something new to satisfy multiple household needs,” said Dawn Aho, principal of client insights, bakery vertical at Circana.

Read more in the October | Q4 issue.

Source: Circana Omnimarket Integrated Fresh, a Chicago-based Market Research Firm (@WeAreCircana) | Latest 52 Weeks Ending July 13, 2025

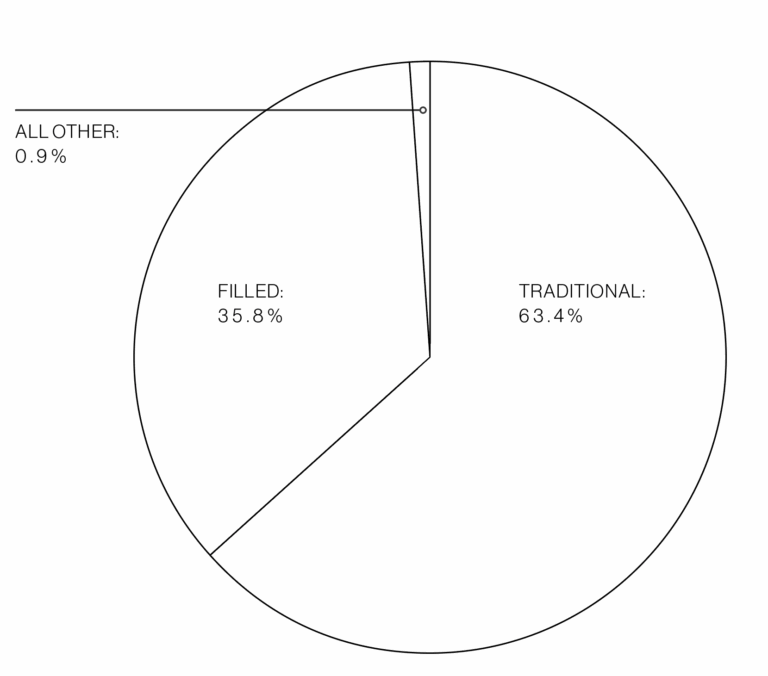

Center-store croissants grew 6.9% in dollar sales and 7.3% in unit sales, with little to no price increases. Representing 63.4% of market share, center-store traditional croissants showed significant gains for dollars and units, at 10.6% and 9.1%, respectively.

Read more in the October | Q4 issue.

Source: Circana OmniMarket Integrated Fresh, a Chicago-based Market Research Firm (@WeAreCircana) | Latest 52 Weeks Ending July 13, 2025

*Percentage rounded to nearest tenth.

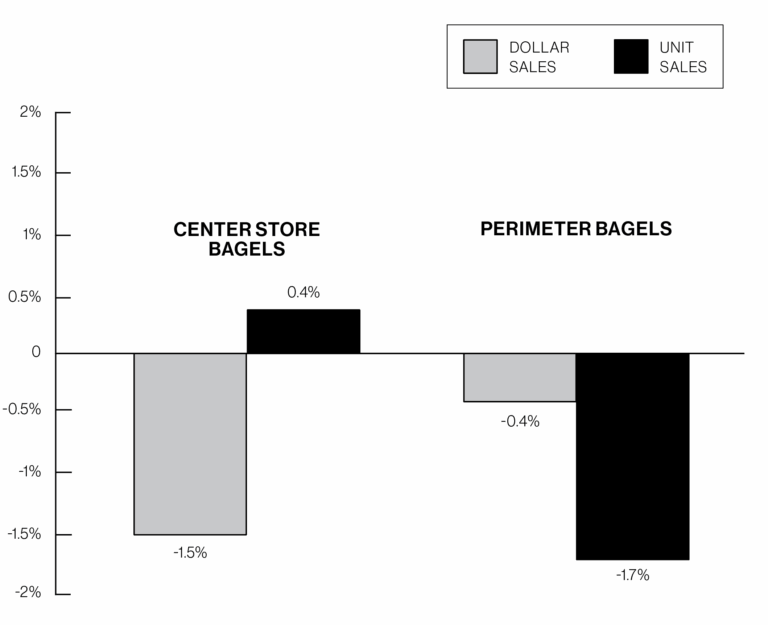

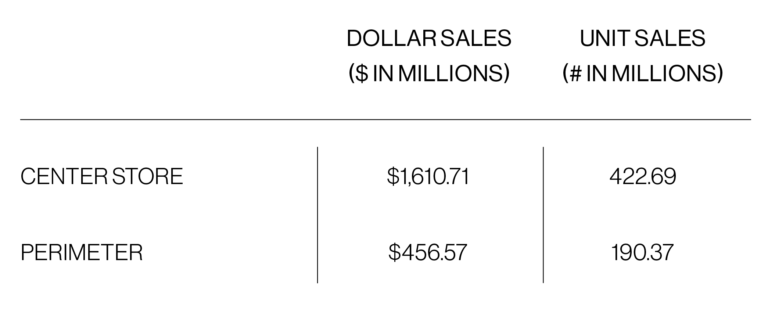

While bagels remain a breakfast favorite, they have also evolved into a customizable snack or anytime meal. The overall bagel category reported more than $2 billion in sales, according to Circana sales figures for the latest 52 weeks ending July 13, 2025. Producers are expanding offerings to include artisanal styles, enhanced flavors and healthy ingredient claims to satisfy diverse consumer preferences.

Read more in the October | Q4 issue.

Source: Circana Omnimarket Integrated Fresh, a Chicago-based Market Research Firm (@WeAreCircana) | Latest 52 Weeks Ending July 13, 2025

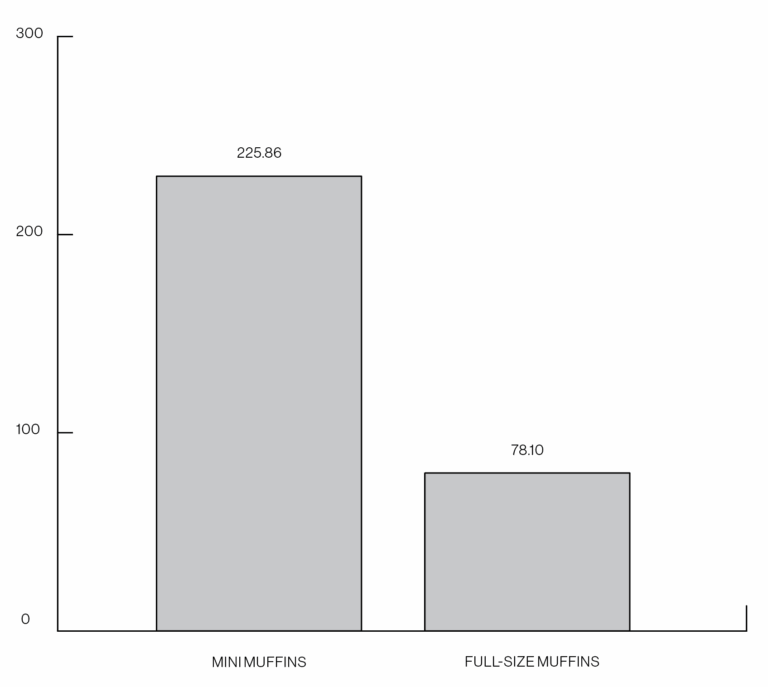

Within center store, mini muffins account for 76% of dollar share and represent the mini-muffin multi-pack universe. Dawn Aho, principal of client insights, bakery vertical at Circana, explained that BBU’s Entenmann’s Little Bites and Bimbo are the top two brands, followed by private label and McKee Foods’ Little Debbie line. However, top brands all show a decline in dollar sales, with the exception of private label and Bimbo, which grew 17.6% and 5.9%, respectively.

Read more in the October | Q4 issue.

Source: Circana Omnimarket Integrated Fresh, a Chicago-based Market Research Firm (@WeAreCircana) | Latest 52 Weeks Ending July 13, 2025