KANSAS CITY, MO — Disruption in the supply chain is hitting all facets of manufacturing in every business realm. In a series following the impact on the baking industry, a group of industry suppliers, associations and consultants gathered with Commercial Baking to assess the situation and discuss potential solutions.

Here’s what they had to say as far as navigating shortages, long lead times and more:

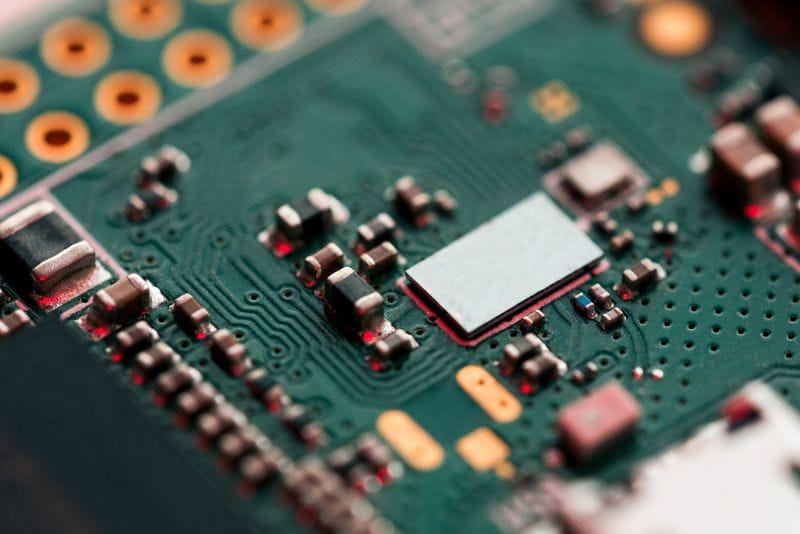

While obvious components such as burners are impacting oven manufacturers, shortages of electrical components like microchips are creating a mass scramble and at times halting production of bakery equipment equipped with PLCs and other electronic features.

“If you have an oven but no burners, it’s just a box with a belt that really doesn’t do anything,” said Shawn Moye, VP of sales for Reading Bakery Systems. “Or if you have a motor that runs with a variable frequency drive and you don’t have the drive, you can’t run the motor.”

In some cases, lead times have increased to as many as 25 weeks for what used to be stock parts.

It can also limit flexibility for an equipment manufacturer’s overall process. Before these shortages, if there was an extended lead time for one component, a supplier could shuffle schedules for customers who were further along in the process or had a smaller project. Today, no project is safe, especially when bakery suppliers are essentially vying with manufacturers in every industry for the same microchips.

“Working with manufacturers in multiple industries, it’s quite clear that we’re all competing for many of the same materials, including computer chips and microchips,” said Lisa Anderson, founder of LMA Consulting and supply chain speaker. “It’s going to be quite some time before we can get the supply chain running smoothly, so there are some interesting waters to navigate.”

Expect the unexpected

At Benchmark, a ProMach brand, Vince Tamborello, VP of business development, noted that component availability is unpredictable, to say the least, causing a drastic shift in project planning.

“We’ve changed a little in how we do our engineering and procurement to get a sense of what the lead times could be,” Tamborello said. “From a practical standpoint, our applications group is quoting longer lead times on machinery because of the inability to predict items we used to have solid lead times on.”

Bakers who are planning to invest in new automation should be aware of the volatility in the availability of components. The impact to an installation is the result of suppliers — and their suppliers — battling a backlog of parts.

In the past, when straight-forward mechanical equipment was paired with a complicated controls order, there was time to flex the schedule. But in the current environment, it’s often a guessing game on what parts are available.

“We could release that mechanical component right away and then take two or three weeks to order the electronics and still have plenty of time to build it,” said Clay Miller, president of Burford Corp. “But with all the uncertainty, we can’t afford to wait; we’re working overtime to get the project through on the chance that some of those parts will be on the latest list of items that are delayed.”

Even with the chaos of delays, Miller looks for silver lining with projects that were already facing overall long lead times before the disruption took hold.

“Our 10- to 14-week lead times are closer to 20- to 24-weeks, but it gives us a fighting chance to get some of those long-lead-time parts like PLCs, HMIs and drives,” he said.

And the issue goes all the way to spare parts, Moye observed. If a baker doesn’t have a spare part sitting on the shelf, that could mean trouble should it need to be replaced in an emergency situation.