DALLAS, TX — In a time when trends are converging — declined in-stock rates, increased gas prices and skyrocketed inflation, just to name a few — a shopper’s path to food purchase is a multi-faceted concept.

In a recent IRI webinar, Sally Lyons Wyatt, executive and practice leader, client insights for IRI, unpacked the combination of inflation, gas prices and income level is impacting how and where people are making their food choices.

While price increases have fueled overall growth across brick-and-mortar as well as online, decreased unit sales reveal that there’s something more at play, whether it’s in-stock shortages due to supply chain and other disruptions, or if people are making different choices when they shop.

From a broad perspective, inflation is playing a role where you see numbers decline in brick-and-mortar while online is growing despite some concerns with refrigerated and frozen departments.

“We see a drop-off from a unit perspective across all of brick-and-mortar,” Lyons Wyatt said. “And yet we see pockets of growth in beverages and some general food within center store, which is helping fuel unit growth online.”

While gas prices are certainly impacting shopper behavior, Lyons Wyatt noted that the impact varies among different income levels. For example, IRI research showed that 66% of Americans with lower income changed their driving habits because of gas prices. And while in the general population, 27% of shoppers were using stocking-up strategies for fewer trips to the supermarket, broken down by income showed that number jumped to 34% for low-income households.

One-stop shopping is also seeing more activity from low-income shoppers, with IRI revealing 28% of shoppers in that category vs. 26% of overall shoppers.

Spending in foodservice, specifically quick-serve restaurants (QSR) is being impacted by income levels, which Lyons Wyatt partly attributed to stimulus money running out and many shoppers reverting to grocery stores and SNAP benefits, though, she noted not all low-income consumers are in the SNAP program.

“This group is really feeling the pressure on their pocketbook, so they’ve definitely decreased spending on QSR,” she said, noting the almost immediately inverse dynamic for on-premise foodservice activity vs. retail spending.

“There was a 1.8 percent decline on-premise and a 1.8 percent increase in retail. I know that’s not dollar-for-dollar, but it’s interesting dynamic.”

Overall, it’s clear that inflation is impacting various groups in different ways, and Lyons Wyatt broke down some cohort groups by generation and income.

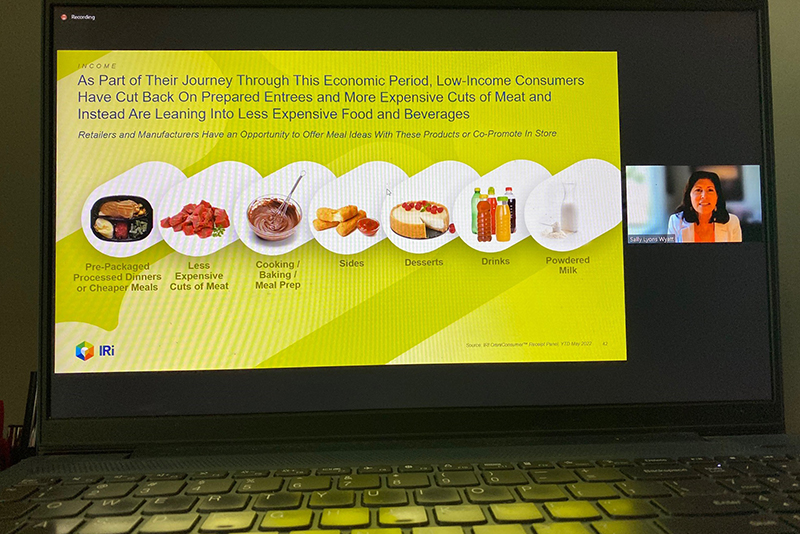

Indexing by income, IRI showed that lower-income shoppers were spending more on drinks, instant coffee and powdered milk, as well as shelf-stable cooking items. She also noted that this group has cut back on prepared entrees and expensive cuts of meat in favor of packaged processed dinners and cheaper meals for more at-home cooking.

Indexing by income, IRI showed that lower-income shoppers were spending more on drinks, instant coffee and powdered milk, as well as shelf-stable cooking items. She also noted that this group has cut back on prepared entrees and expensive cuts of meat in favor of packaged processed dinners and cheaper meals for more at-home cooking.